Artificial Intelligence

Cyber

Future Telecoms

Materials

Net zero

Quantum

Robotics

Wise words and waggishness… January 2026

Reading time: 13 mins

As investors shift focus from quantum hardware to software, the race is on to prove utility, and to overcome the twin limits of talent and time

According to McKinsey’s Quantum Technology Monitor 2025, quantum technology start-ups globally raised almost $2 billion in 2024, a 50% jump on the previous year. Quantum computing companies alone received an estimated $650–$750 million that year and are expected to pass $1 billion in 2025. For now, the story has been dominated by hardware, with big tech giants and dedicated quantum hardware firms racing to prove advantage one qubit at a time. But it’s software that will make those machines matter, and where analysts see the next surge of innovation and growth.

“There’s often talk of a chicken-and-egg challenge between quantum hardware and software,” says Yuval Boger, chief commercial officer at QuEra. “But in reality, they must evolve together. Quantum hardware needs software. Just like a powerful CPU is useless without an operating system, software also needs the right hardware foundations to demonstrate value.”

McKinsey says that in 2024, most new start-ups emerged in equipment, components and application software, with a value shift moving from components toward application software. It’s perhaps a sign of market progress, more adolescence than maturity; something that Robert Sutor, founder of Sutor Group Intelligence and Advisory, refers to as the inevitable settling stage of a fast-moving field.

“It is risky for software companies working at the application level because the machines are not yet powerful enough for everyday production work,” he says. “Many of the companies essentially work as consultants with end-user corporations who are trying to understand quantum’s potential and get a head start.”

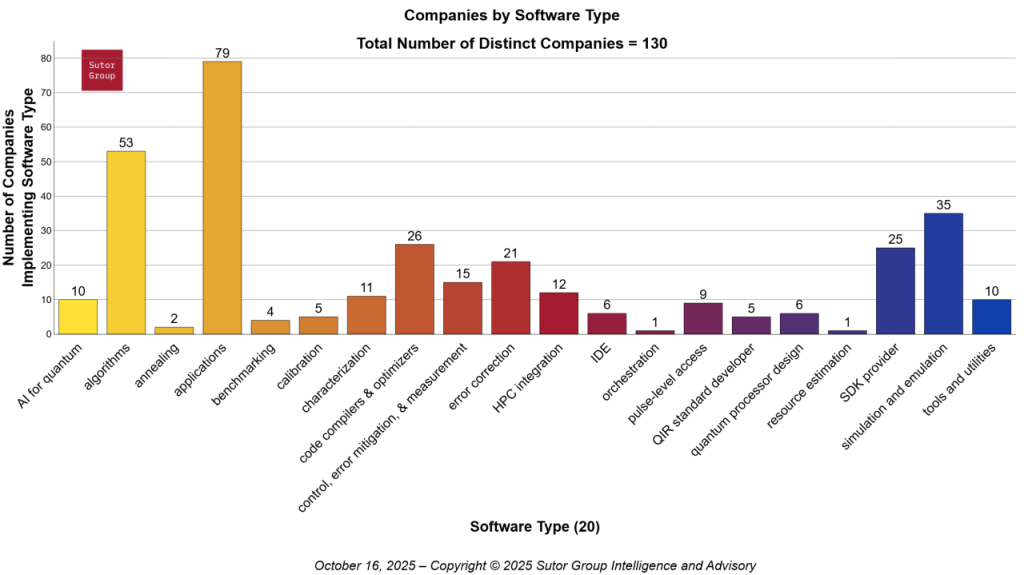

Sutor believes the ecosystem is entering a natural phase of refinement. Early growth has produced plenty of duplication. “There are several widely used quantum software development kits such as Qiskit from IBM, Cirq from Google, and PennyLane from Xanadu,” he says. “However, there are over 20 others. I expect some consolidation in this market, along with new generations that build on what we have done so far.”

That process of convergence, he argues, mirrors what happened in AI a decade ago, when competing frameworks eventually coalesced around TensorFlow and PyTorch. The same will happen in quantum once the first credible use cases start to pay off – a sign not of decline or slow growth but of discipline.

That correction phase may be uncomfortable, but it’s also necessary. Consolidation clears the noise and exposes what’s real and useful. What’s emerging is a clearer split between platform builders, algorithm specialists, and the hybrid companies connecting both.

The appeal for investors is obvious. Software is agile, capital-light and largely hardware-agnostic. Gemma Martynwood, European patent attorney and partner at EIP, says that algorithms are now driving confidence in the wider quantum ecosystem.

“To get the most out of quantum, algorithms need to develop hand-in-hand with hardware,” she says. “Quantum hardware is still noisy and fragmented across competing modalities, and quantum error correction is fiendishly complex. However, software gives hardware purpose.”

She calls software “the low-risk, high-leverage entry point into the quantum stack.” The same logic underpins the rise of companies such as Phasecraft, which has just launched Mondrian, a development platform designed to accelerate classical optimisation algorithms using quantum techniques.

Another major UK player, Riverlane, has taken a complementary route, building the software and operating systems that make quantum error correction practical, an essential step in scaling future machines. Spun out of the University of Cambridge in 2016, Riverlane recently raised £45 million in a Series B round to expand its Deltaflow and Deltakit platforms. It works with partners including Intel, Rigetti, and Oxford Quantum Circuits to help standardise how quantum processors communicate and recover from noise.

According to Ashley Montanaro, co-founder and CEO of Phasecraft, quantum technology is now on “the cusp of doing genuinely useful things better than you can using standard methods.” He sees growing interest from industries looking for early advantage. “We’re working with National Grid and BT,” he says. “There’s a recognition that the technology is getting far closer to deployment. If you wait and see, then you’ll be too late to be one of the first movers.”

That urgency is partly pragmatic. Hybrid quantum-classical architectures have become the sensible bridge between ambition and reality. “Almost all algorithms that people want to run will be of this hybrid nature,” Montanaro says, “simply because it’s making best use of the quantum hardware alongside the classical hardware.”

For all the momentum around funding and proof-of-concept results, progress in quantum software still depends on the people who can actually write it. This remains something of a barrier to entry, or at least to the ability to seriously scale a quantum software company.

“There are very few people who can do this work,” says Montanaro. “The availability of talent is really constrained. There are a very small number of people worldwide who can develop quantum algorithms and understand how to make the software work.”

That scarcity is a natural by-product of quantum’s youth, of course. The skill set required sits somewhere between physics, mathematics, computer science, and systems engineering. The result is a global shortage of ‘translators’, developers who can move fluently between quantum theory and usable code.

Montanaro believes the UK has a particular opportunity here, at least for early-stage start-ups, as the requirements in terms of capital are far lower. But turning academic strength into commercial scale will require sustained focus and support. Universities such as Bristol, Cambridge, and UCL are already strong performers in this respect, building dedicated quantum engineering programmes and nurturing new ventures, while regional innovation hubs such as SETsquared and Science Creates provide the connective tissue between labs and investors. Spinouts are emerging; the challenge is to make them emerge faster.

The same pattern is visible elsewhere in Europe, with Denmark, France, and the Netherlands all investing heavily in dedicated quantum incubators and national talent programmes. Together, these ecosystems are beginning to close the gap between academic excellence and entrepreneurial momentum, but the need for scale remains acute.

Without a broader pool of algorithm designers, compiler engineers, and hybrid-architecture specialists, the wave of new software investment risks outpacing the people needed to deliver it. And yet the direction of travel is positive. The UK’s National Quantum Computing Centre (NQCC) is helping to align academic and industrial research, while Europe’s cross-border initiatives, from Quantum Delta NL to France’s La Stratégie Nationale Quantique, are creating new opportunities for collaboration. But as with early AI, the real constraint on progress isn’t hardware or money, it’s translation.

If people remain quantum software’s scarcest resource, intellectual property is fast becoming its most valuable.

“Algorithms help benchmark progress and steer development towards fault tolerance,” says Martynwood, “but they also define where the intellectual property sits in the stack. That’s going to become increasingly important as companies start filing patents and building defensible positions.”

She notes that the patent landscape is already shifting from hardware blueprints to algorithmic and middleware innovations. “The key is to focus on software that offers commercially significant benefits,” she says, “rather than spending valuable time and resources on proof-of-concept software directed to toy problems.”

That pragmatism is reshaping investment logic. Martynwood points to Phasecraft’s recent funding round as evidence of software’s new appeal. “Investors are waking up to software’s scalability, agility, and lower capital risk,” she says. “Hardware still draws big money, but software is increasingly seen as the short-term value play and a long-term strategic hedge.”

The change is also visible in the way collaboration happens. Platforms such as AWS Braket and Azure Quantum allow developers to test algorithms on multiple hardware systems through the cloud, removing the need for billion-dollar infrastructure and encouraging cross-pollination between software firms and hardware providers.

As a result, Martynwood says the first credible commercial use-cases are beginning to appear. “Chemistry, finance, logistics, and optimisation are all promising early applications,” she explains. “The most natural ‘killer app’ may come from pharmaceuticals, where the inherently quantum nature of molecular simulation plays to the technology’s strengths.”

Her view reinforces a wider theme across the sector that the race for quantum advantage will likely be decided not by who builds the biggest machine, but by who builds the most adaptable layer of software around it.

And that brings us back to big market drivers and investment interest. The flow of capital into software suggests something fundamental has shifted. In 2025 alone, Multiverse Computing in Spain closed a $215 million Series B, Classiq in Israel raised $110 million, and Phasecraft secured $34 million. These are serious mid-stage investments, perhaps an indication that quantum software is gaining pace and moving away from the experimental labels.

There are plenty of analogies, the main one being that it’s like the old mainframe industry, where software was in many ways waiting for hardware to catch up. Montanaro says he’d go further back, when progress relied as much on compilers and operating systems as on transistor counts. “It’s a bit like the post-war computing industry,” he says, but adds that it’s now beginning to show “where the real opportunities lie.”

It’s an honest assessment. Quantum developers are beginning to think like software engineers: building reusable code, testing on cloud-based simulators, and chasing practical use-cases rather than perfect qubits. We now just need more of them.

Working as a technology journalist and writer since 1989, Marc has written for a wide range of titles on technology, business, education, politics and sustainability, with work appearing in The Guardian, The Register, New Statesman, Computer Weekly and many more.

Quantum

Reading time: 10 mins

Quantum

Reading time: 10 mins

Quantum

Reading time: 11 mins

Robotics

Reading time: 1 mins

Quantum

Reading time: 3 mins