Artificial Intelligence

Cyber

Future Telecoms

Materials

Quantum

Wise words and waggishness… February 2026

Reading time: 2 mins

With public funding surging and private investment following, countries and companies are vying for early market share and technology breakthroughs, at least according to McKinsey and Capgemini reports

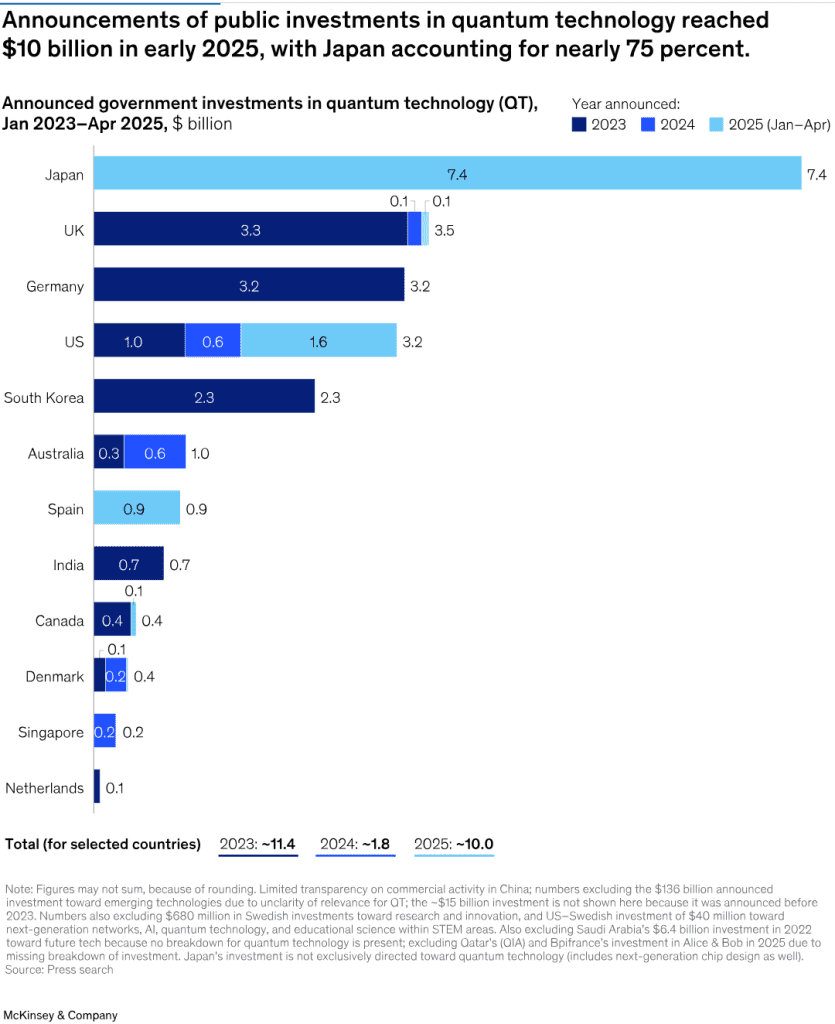

Governments around the world are no longer quietly funding quantum research. According to McKinsey’s The year of quantum: From concept to reality in 2025 report, public funding is now surging.

In the US, the CHIPS and Science Act has already channelled billions into national quantum programmes. In Europe, the European Commission’s new Quantum Strategy commits to building a sovereign, full-stack quantum infrastructure. Countries from China to Canada are scaling efforts in tandem and this all follows the UK’s promise of £670m during the recent industrial strategy announcement.

This isn’t just R&D spending. It’s market-shaping capital, with nation states now racing to secure intellectual property, talent pipelines, and technology leadership. And that includes business communities.

McKinsey’s latest global forecast estimates that quantum technologies could create $97 billion in value by 2035, with quantum computing accounting for $72 billion of that total. The firm calls 2025 a turning point, the moment quantum moves from “concept to reality”.

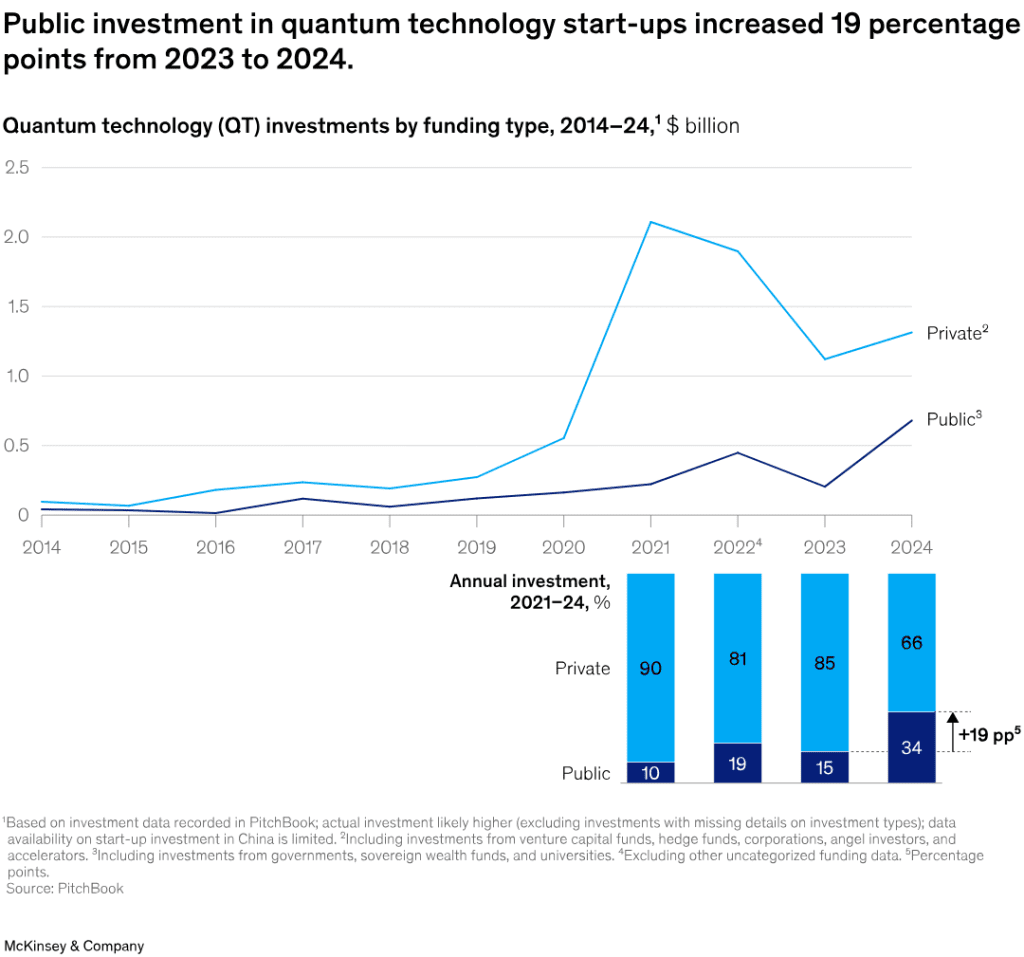

Private capital is also responding. Quantum start-ups raised $2 billion in 2024, up 50% year-on-year. That investment has translated into revenue. The sector generated between $650 million and $750 million last year, with projections pointing to more than $1 billion in 2025.

What’s changed is the nature of the opportunity. While the platform race between trapped ions, photonics, superconducting qubits, and neutral atoms continues, the business focus is shifting to use cases.

Simulation, especially in pharma, materials, and chemicals, is emerging as the most likely to deliver near-term returns. Optimisation and machine learning applications remain longer-term bets, but the tone has changed. Quantum is now being asked to justify itself, to a certain extent – to start delivering some returns on all the investments.

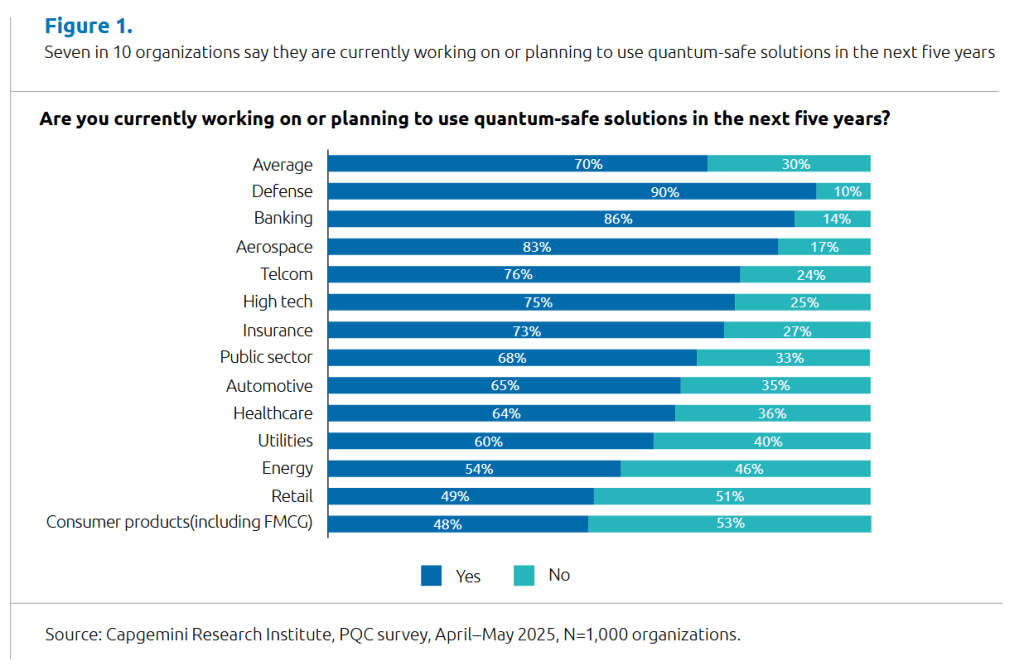

Arguably the most immediate business driver is cybersecurity. In 2024, concern over quantum’s ability to break classical encryption was still treated as a future threat. In 2025, that seems to have changed. Capgemini’s recent Future Encrypted report and survey of 1,000 organisations found that 70% are now planning or piloting post-quantum cryptography, largely in response to the threat of “harvest-now, decrypt-later” (HNDL) attacks. These involve intercepting encrypted data today, with the expectation that it can be decrypted by quantum computers in the future.

Recent claims from China have added some urgency. Researchers in Shanghai say they’ve used a quantum computer to factor small RSA keys, while China Telecom has unveiled what it describes as the world’s first “unhackable” quantum cryptography system, combining quantum key distribution with post-quantum algorithms. While experts caution that large-scale RSA remains unbroken, these developments are seen as clear signals of intent in a growing global race for quantum-secure infrastructure.

Jason Soroko, senior fellow at Sectigo, notes that the belief quantum decryption is decades away is increasingly difficult to defend. Engineering progress is accelerating, he says, and companies like Google, IBM and Microsoft are already demonstrating building blocks of cryptographically relevant machines.

Financial institutions are responding. Quantum Computing Inc. recently secured a purchase order from a top-five US bank to develop a quantum cybersecurity testbed, proof that quantum risk is no longer a theoretical concern but a strategic priority.

But for some, the comparison is with Y2K, an infrastructure-wide challenge that demands proactive planning, even without a clear deadline.

“Quantum resembles a Y2K-scale, enterprise-wide IT issue but without a fixed end date,” said Jonathan Nguyen-Duy, CTO at Arqit. “Thankfully, scalable, crypto-agile defences are available. Businesses have a rare opportunity to get ahead of the curve.”

One reason quantum is being taken more seriously is that it’s becoming easier to access. Public cloud platforms, including IBM Quantum, Amazon Braket and Microsoft Azure Quantum, now offer businesses a way to test, simulate, and build hybrid quantum-classical workflows without needing to own hardware or hire physicists.

This has opened the door to experimentation at scale. While few companies expect quantum advantage overnight, many are beginning to map their workloads to potential quantum improvements, particularly in areas where performance bottlenecks or simulation complexity already limit progress. As a result, the conversation has shifted from “if” to “when” and “how.”

The geopolitical dimension is also becoming harder to ignore. The European Union’s new Quantum Strategy, unveiled in April, lays out plans for a sovereign, full-stack capability covering quantum computing, communications and sensing. The aim is not only to accelerate innovation, but to reduce dependence on non-EU cloud providers and tech platforms, particularly as quantum IP becomes a strategic asset.

A recent report by the Center for European Policy Analysis (CEPA) frames Europe’s push as a direct response to US quantum dominance. While American firms currently lead in platform development and commercial deployment, Europe’s bet is on building resilience and autonomy backed by public–private collaboration and new standards for security and performance.

For businesses operating internationally, these strategies are more than symbolic. They signal a future in which market access, compliance, and investment may hinge on alignment with national or regional quantum frameworks.

The forces driving quantum in 2025 are not just technological. They are structural, financial, and political. Businesses are being squeezed from multiple angles. Regulators are raising the bar on cryptographic readiness, with governments investing in sovereign capabilities, and competitors beginning to trial quantum-enhanced workflows.

Where last year’s forecasts asked whether quantum was viable, this year’s question is different. Are you ready to respond and take advantage of quantum before you’re forced to? The clock has already started.

Working as a technology journalist and writer since 1989, Marc has written for a wide range of titles on technology, business, education, politics and sustainability, with work appearing in The Guardian, The Register, New Statesman, Computer Weekly and many more.

Quantum

Reading time: 10 mins

Quantum

Reading time: 10 mins

Future Telecoms

Reading time: 2 mins

Quantum

Reading time: 11 mins

Quantum

Reading time: 5 mins