Artificial Intelligence

Materials

Net zero

Five energy technologies to watch in 2026 as the UK’s flexibility challenge comes into focus

Reading time: 5 mins

Newly announced SETsquared and QantX vehicle to deliver investment and trigger more pension capital for start-ups and spinouts

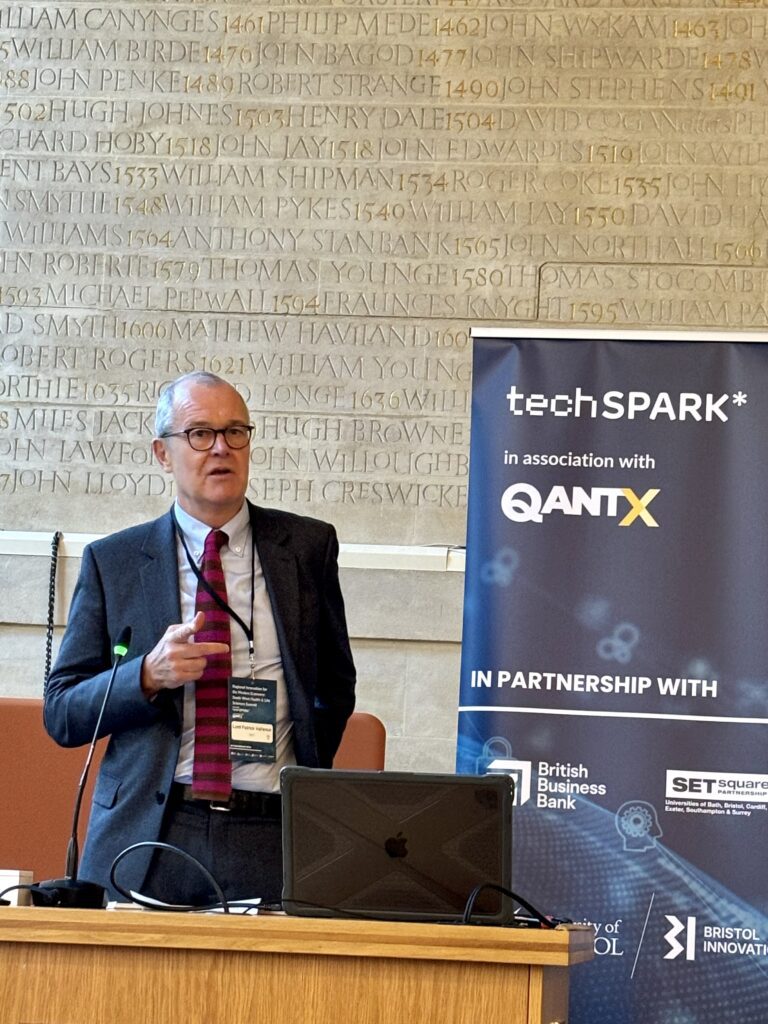

Sir Patrick Vallance, the UK government’s Minister for Science, Research, and Innovation, says that de-risking innovation is critical to the UK’s economic growth plans and that the government and private investors have to work better together to enable UK start-ups to grow and thrive.

Speaking at the launch of a £300m start-up investment vehicle spearheaded by SETsquared and QantX, as part of the Bristol Tech Festival, Vallance outlined this need for long-term investment in start-ups and university spinouts to grow the UK economy.

”Partnership between the private and public sectors is the very foundation of our science and tech story,” he said. “Science and tech and innovation, they aren’t luxuries. They are central to how we improve, achieve growth that is faster than average and have a dramatic increase in productivity.”

Vallance welcomed the SETsquared and QantX investment programme as a clear example of how the public and private sectors can work together to unlock early-stage investment in sectors such as clean energy, life sciences, and deep tech.

Central to Vallance’s message was the need to de-risk innovation. While the UK has excelled in scientific research, it has historically been a challenge translating research into large-scale commercial ventures, he said, particularly in regions like the South West. Vallance explained that one of the main barriers has been uncertainty in funding.

“We can remove some of that uncertainty by giving more stability around funding and approaches,” he said. ”One of the things that government struggles with is uncertainty. Innovation requires the acceptance of failure.”

The £300m from SETsquared and QantX addresses this issue by providing patient capital, helping high-risk start-ups secure the early funding they need. By reducing financial uncertainty, it aims to stimulate innovation in areas that have previously struggled to attract investors, especially in comparison to the ‘Golden Triangle’ (London, Oxford, and Cambridge).

Marty Reid, executive director of SETsquared, emphasised the importance of this initiative in closing the region’s funding gaps.

“The potential scale and quality of science and technology companies emerging from across the SETsquared university clusters is a match for any ecosystem,” said Reid. “Creating this new investment vehicle could be a vital step forward in addressing funding gaps we see today, and through a deep connection with our support ecosystem, could inspire a new generation of talent who will get technologies out of the lab and shape the industries of tomorrow.”

A significant component of this strategy involves unlocking pension fund capital, an underutilised resource in the UK’s venture capital ecosystem – as Hermann Hauser, ARMs Holdings founder, recently pointed out to BI Foresight.

Darren Jones, Chief Secretary to the Treasury and Bristol North West MP, highlighted the government’s focus on reviewing how pension funds could be better leveraged to support high-growth sectors.

“We’re looking at a pension review that will look at what more can be done to deliver better outcomes for pensioners, whilst unlocking millions of pounds of productive investment for UK PLC,” said Jones.

Currently, only 10% of UK venture capital comes from pension funds, compared to 70% in the United States. Louis Taylor, CEO of the British Business Bank, stressed that increasing the contribution of pension funds could significantly amplify the scale-up potential of UK start-ups.

“If pension funds were to contribute more to venture capital, we could see fewer innovative companies moving abroad in search of funding,” said Taylor.

By making early-stage investments in deep tech and sustainability sectors less risky, this vehicle aims to create a more attractive environment for pension fund managers to inject capital into innovation, fostering an ecosystem that keeps the UK’s intellectual property and innovation pipelines within the country.

However, as both Vallance and Jones emphasised, investment alone cannot drive sustainable growth. Addressing the skills gap is equally critical to ensuring that science and tech start-ups can scale successfully.

Jones underscored that a broader strategy linking investment, housing, transport, and education is needed to support the next generation of innovators.

“We need to go further and faster,” he said, referring to the government’s UK infrastructure ‘mission-driven’ plans.

For Taylor at the British Business Bank, this is critical if the UK is not going to be seen as purely “an incubator of early-stage and mid-stage companies.”

He added that, “we find ourselves with a persistent gap between our research capabilities and the commercial outcomes that should naturally evolve.”

And yet, Taylor was optimistic. While there are challenges, he said that schemes such as the SETsquared QantX investment are a clear indication of the direction the UK needs to take when it comes to university spinouts and start-ups.

“We are sitting on a goldmine,” he said.

Working as a technology journalist and writer since 1989, Marc has written for a wide range of titles on technology, business, education, politics and sustainability, with work appearing in The Guardian, The Register, New Statesman, Computer Weekly and many more.

Quantum

Reading time: 10 mins

Quantum

Reading time: 10 mins

Future Telecoms

Reading time: 2 mins

Quantum

Reading time: 11 mins

Quantum

Reading time: 5 mins